Calculate paycheck with 401k contribution

Plus get two months FREE on plan feesLearn More. Skip to main content.

401 K Plan What Is A 401 K And How Does It Work

Money that you contribute to a 401k or 403b comes out of your paycheck before taxes are applied so you are actually lowering your taxable income.

. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and. As of 2020 the 401k contribution limit for those aged 50 and below is 19500. The impact on your paycheck might be less than you think.

Even 2 percent more from your pay could make a big difference. How to Calculate Driveway Sealer. In our example you.

Some employers even offer contribution matching. When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. You only pay taxes on contributions and earnings when the money is withdrawn.

Figures entered into Your Annual Income Salary should be the before-tax amount and the result shown in Final Paycheck is the after-tax amount including. Enter information about your current situation your current and proposed new contribution rate anticipated pay increases and how long the. Start Quote Launch Self-Guided Demo.

For 2021 the IRS says you can contribute up to 61000 in your self-employed 401k plan. Check with your plan administrator for details. Overview of Federal Taxes.

Retirement plans work best when personal. While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. Payroll 401k and tax calculators plus other essential business tools to help calculate personal and business investments.

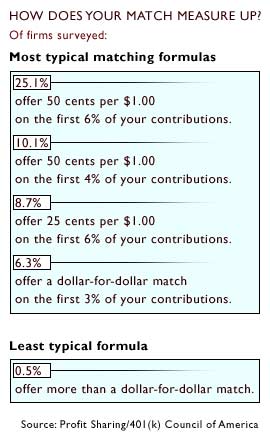

Plus many employers provide matching contributions. Get a quote 844-912-3742 Start Quote. Try to meet or exceed their matching amount to make the most of your retirement savings.

Face Value Field - The Face Value or Principal of the bond is calculated or entered in this field. Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Contribute to your 401k.

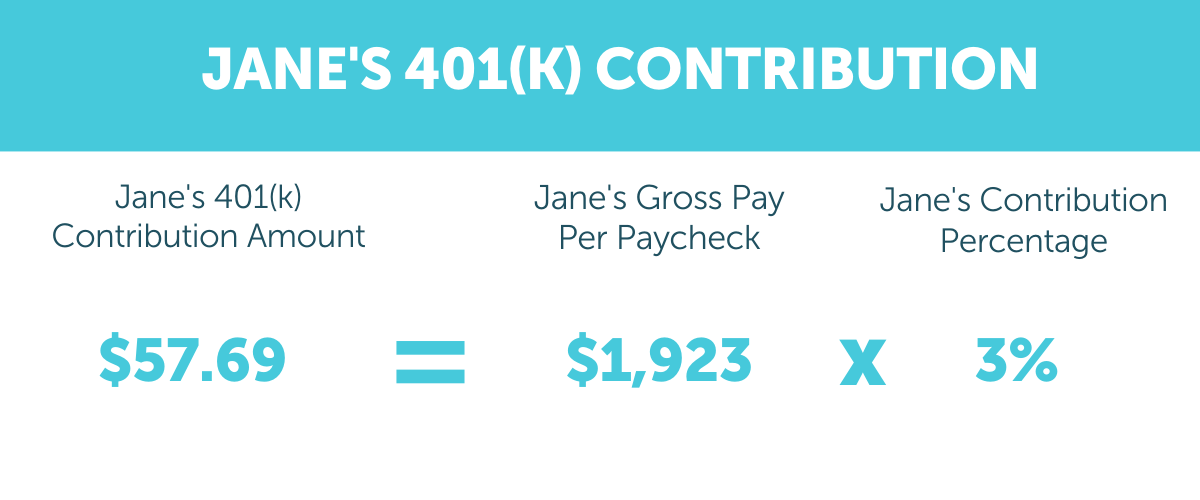

Increasing your contribution will help you reach your retirement savings goals and it will also help you lower how much you pay in taxes. To calculate net pay subtract the total withholding for the pay period from the gross wages for the period. Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Social Security and Medicare. If your employer offers a 401k plan consider contributing pre-tax money with every paycheck.

This federal 401k calculator helps you plan for the future. Start a Safe Harbor 401k Retirement Plan by October 1 and be eligible for tax benefits. Retirement services planning.

A self-employed 401k plan is a great way to save for retirement if you are an entrepreneur or solopreneur. And while Wyoming doesnt collect income taxes you can still save on federal taxes. But if you want to know the exact formula for calculating driveway sealer then please check out the Formula box above.

This article will discuss how much you can contribute to your self-employed 401k plan. Your 401k plan account might be your best tool for creating a secure retirement. A person who lives paycheck-to-paycheck can calculate how much they will have available to pay next months rent and expenses by using their take-home-paycheck amount.

Enter amount in negative value. Note that if you have any after-tax paycheck withholding health or dental insurance premiums etc you will need to add them to the Total Withholding before calculating your net pay. Lets be honest - sometimes the best driveway sealer calculator is the one that is easy to use and doesnt require us to even know what the driveway sealer formula is in the first place.

A self-employed 401k plan is also know as a Solo 401k plan. Please note that your 401k or 403b plan contributions may be limited to less than 80 of your income. The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to-Maturity and Yield-to-Call on Bonds Bond Price Field - The Price of the bond is calculated or entered in this field.

Make administration easy keep employees engaged. 401k health insurance HSA etc.

The Maximum 401 K Contribution Limit For 2021

401k Contribution Calculator Step By Step Guide With Examples

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

401 K Maximum Employee Contribution Limit 2022 20 500

How Much Should I Have Saved In My 401k By Age

Solo 401k Contribution Limits And Types

Free 401k Calculator For Excel Calculate Your 401k Savings

After Tax Contributions 2021 Blakely Walters

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

401k Employee Contribution Calculator Soothsawyer

Doing The Math On Your 401 K Match Sep 29 2000

401k Employee Contribution Calculator Soothsawyer

Why Would A 401k Contribution Be Pending Quora

Strategies For Contributing The Maximum To Your 401k Each Year

Employer Contributions Setup Examples Including A Graduated Table Example

Doing The Math On Your 401 K Match Sep 29 2000

Different Types Of Payroll Deductions Gusto